Car Insurance Explained: Everything You Need to Know in 2026

Car insurance is no longer just a legal requirement. In 2026, it has become an essential financial protection tool for millions of drivers worldwide. With rising vehicle costs, advanced technology, and unpredictable road conditions, having the right car insurance policy can save drivers from significant financial loss.

This guide explains what car insurance is, how it works, the different types of coverage available, and how to choose the best policy for your needs. Whether you are a new driver or looking to switch providers, this article will help you make an informed decision.

What Is Car Insurance?

Car insurance is a contract between a vehicle owner and an insurance company. In exchange for a regular payment known as a premium, the insurer agrees to cover specific financial losses related to accidents, theft, damage, or liability.

Most countries require drivers to have at least basic insurance coverage. However, optional coverage can provide additional protection beyond legal requirements.

Why Car Insurance Is Important

Driving always involves risk. Even careful drivers can experience accidents caused by weather, road conditions, or other drivers. Car insurance helps reduce the financial burden associated with these risks.

Without insurance, drivers may be responsible for expensive repairs, medical bills, or legal claims. In serious cases, these costs can reach thousands or even millions of dollars.

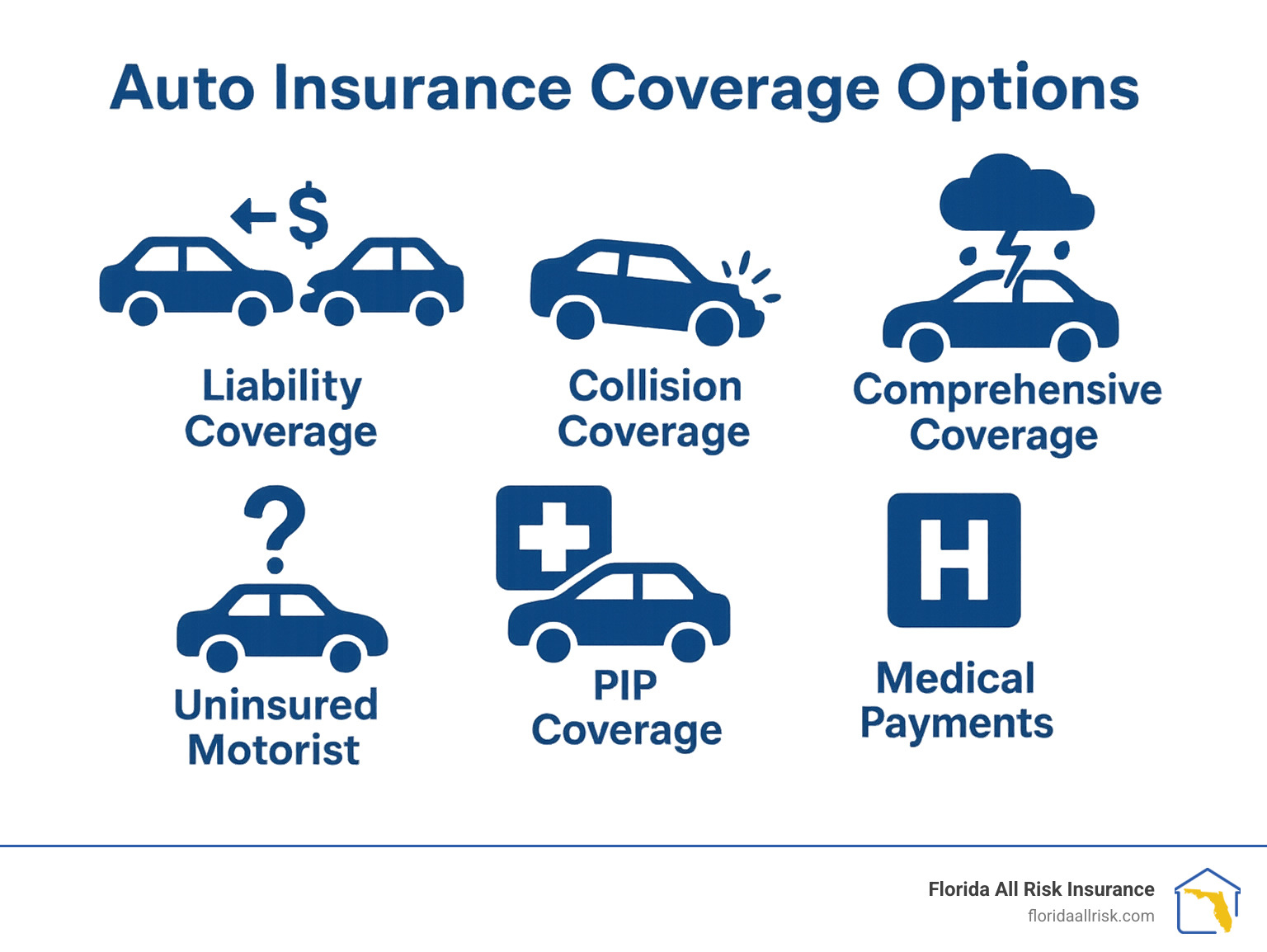

Types of Car Insurance Coverage

Understanding different types of car insurance coverage is essential when selecting the right policy. Each type of coverage serves a specific purpose.

1. Liability Insurance

Liability insurance covers damages or injuries you cause to others. It does not cover your own vehicle. This is the minimum coverage required in most regions.

2. Collision Coverage

Collision insurance pays for damage to your vehicle after an accident, regardless of who is at fault. This coverage is especially useful for newer or more expensive cars.

3. Comprehensive Coverage

Comprehensive insurance protects against non-collision events such as theft, fire, vandalism, natural disasters, and falling objects.

4. Personal Injury Protection

This coverage helps pay medical expenses for you and your passengers, regardless of fault. It may also cover lost wages and rehabilitation costs.

5. Uninsured and Underinsured Motorist Coverage

This type of insurance protects you if you are involved in an accident with a driver who has little or no insurance.

How Car Insurance Premiums Are Calculated

Insurance companies use several factors to determine how much you pay for car insurance. Understanding these factors can help you reduce your premium.

- Your driving history and accident record

- Age, location, and driving experience

- Type and value of your vehicle

- Annual mileage

- Coverage limits and deductibles

Drivers with clean records and safe driving habits generally receive lower insurance rates.

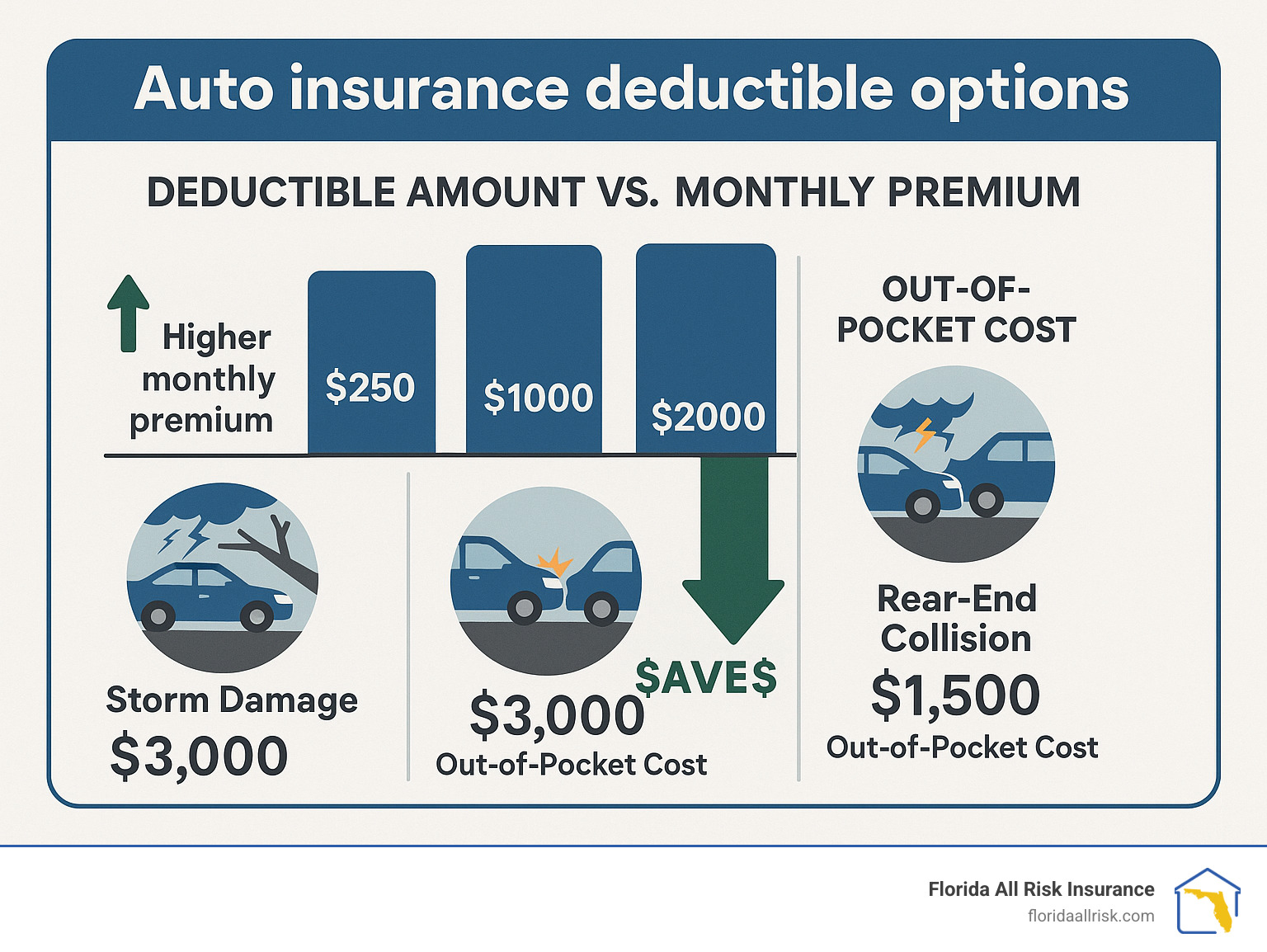

What Is a Deductible?

A deductible is the amount you pay out of pocket before insurance coverage applies. Higher deductibles usually result in lower monthly premiums, but they increase your financial responsibility during a claim.

Choosing the right deductible depends on your budget and how much risk you are willing to take.

How to Choose the Best Car Insurance Policy

Choosing the right car insurance policy requires careful evaluation. The cheapest option is not always the best.

Consider the following when selecting a policy:

- Coverage limits that match your financial needs

- Customer service reputation

- Claim processing speed

- Discounts for safe driving or bundled policies

Common Car Insurance Mistakes to Avoid

Many drivers make mistakes that lead to insufficient coverage or higher costs.

Common mistakes include:

- Choosing minimum coverage only

- Ignoring policy exclusions

- Failing to update information after life changes

- Not comparing multiple insurance quotes

The Future of Car Insurance in 2026

By 2026, car insurance is becoming more technology-driven. Telematics and AI-based pricing models allow insurers to offer personalized policies based on driving behavior.

Usage-based insurance, digital claims, and automated risk analysis are reshaping the industry, making policies more flexible and efficient.

Final Thoughts

Car insurance is a critical part of responsible vehicle ownership. It provides financial protection, peace of mind, and legal compliance for drivers.

By understanding coverage options, premiums, and future trends, drivers can choose policies that offer real value and long-term security.